TRADE & ECONOMY

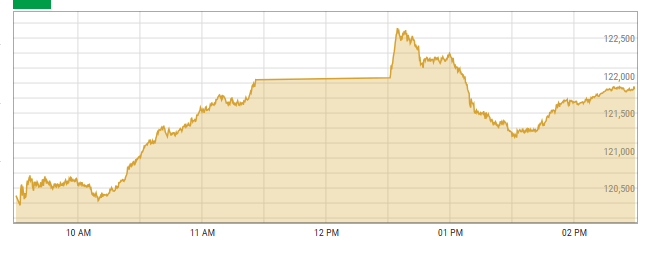

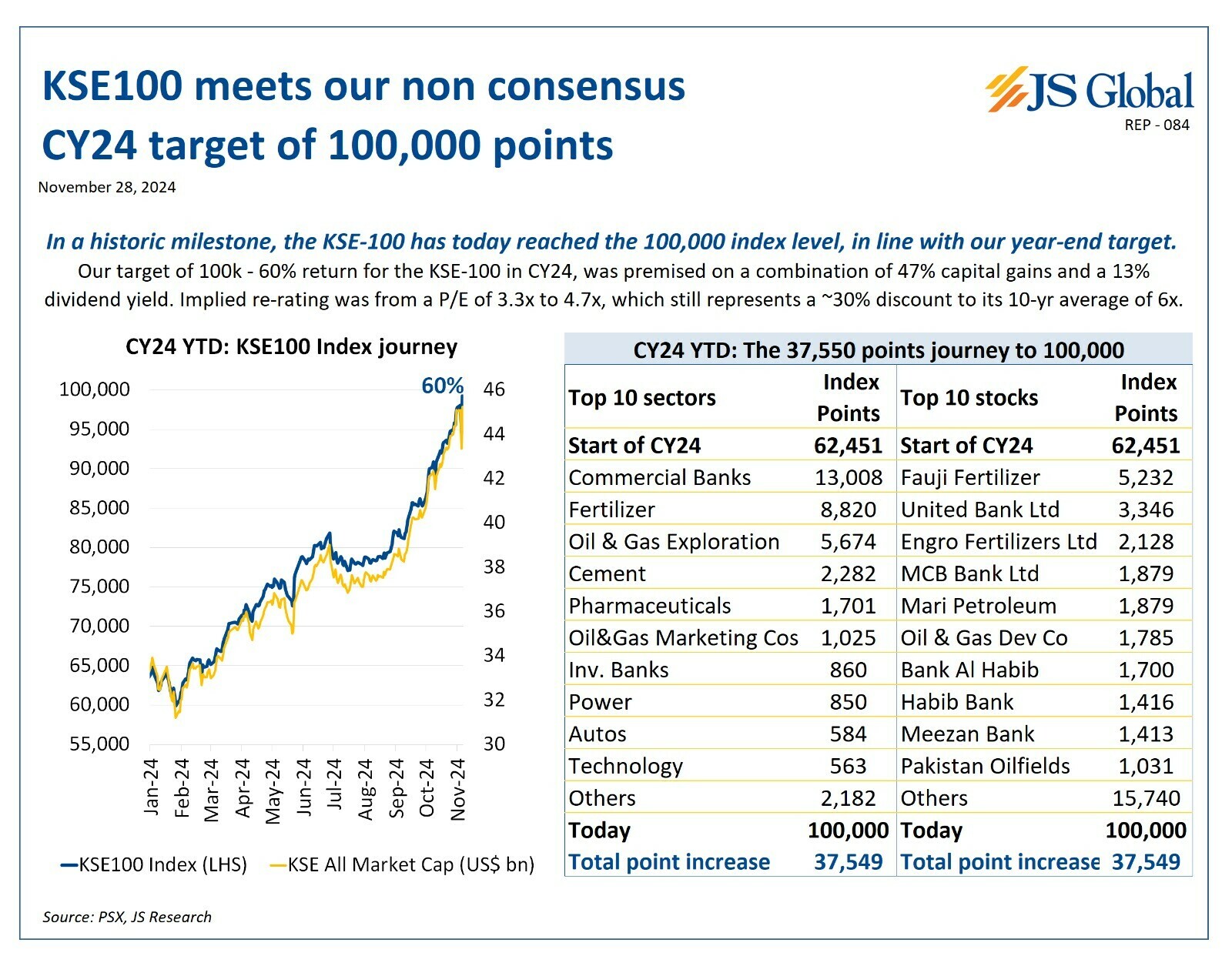

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index surged past the 100,000-point mark for the first time in its history on Thursday, closing at 100,082.77 points, a gain of 813.52 points (0.82%) from the previous close.

This historic milestone follows a period of remarkable growth, with the index delivering a 150% return in just 17 months, climbing from 40,000 points in June 2023.

Factors Driving the Rally

- IMF Bailout: The new loan package coupled with fiscal and monetary discipline boosted investor sentiment.

- Easing Inflation: Inflation fell from a peak of 38% to 7.2%, reducing economic pressure.

- Policy Rate Adjustments: The State Bank of Pakistan (SBP) lowered the policy rate by 700 basis points this year, stimulating market activity.

- Investor Optimism: Mohammed Sohail, CEO of Topline Securities, attributed the rally to a combination of macroeconomic stability, declining interest rates, and improved liquidity.

Despite the rally, analysts noted that the market remains undervalued with a price-to-earnings ratio of 5x, significantly below its historical average of 7x.

Long-Term Perspective

Yousuf M. Farooq, director of research at Chase Securities, emphasized the long-term growth potential of the PSX.

“At an annual compounded return of 17%, the KSE-100 Index could reach 480,000 points by 2034 and 2.3 million points by 2044,” he predicted, advising retail investors to adopt a disciplined, long-term investment strategy.

Prime Minister’s Remarks

Prime Minister Shehbaz Sharif congratulated the nation, calling the milestone a testament to the trust of the business community in government policies. He highlighted the government’s focus on stabilizing the economy and assured continued efforts to promote development.

Future Outlook

As political and macroeconomic stability persists, market analysts foresee continued growth in the equity market, supported by declining fixed income yields and favorable valuations.