TRADE & ECONOMY

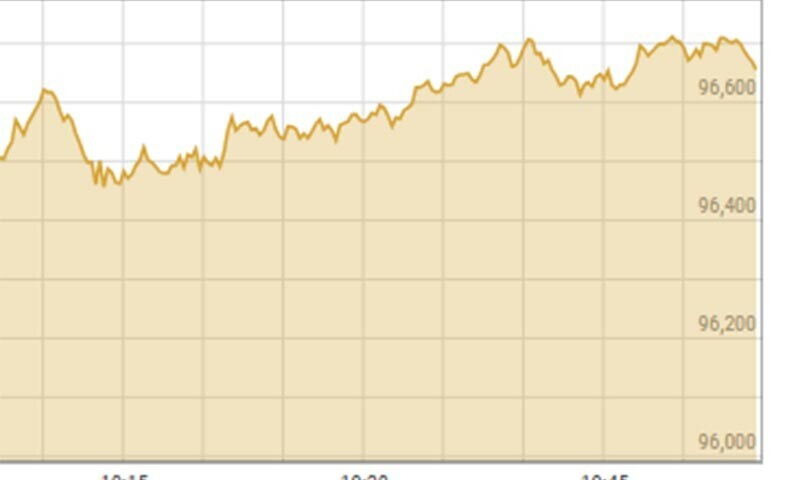

The benchmark KSE-100 index displayed significant volatility on Wednesday, rallying 847.17 points (+0.88%) to reach 96,703.83 in the morning before closing in the red at 95,546.45, down by 310.21 points from the previous close.

Yousuf M. Farooq, director research at Chase Securities, attributed the morning rally to retail-driven interest in stocks like K-Electric Limited (KEL) and Kohinoor Spinning Mills (KOSM). “KEL's rise is fueled by rumours of an imminent multi-year tariff approval, which could enhance investor confidence and enable a potential transaction,” he noted.

Farooq also highlighted improved macroeconomic stability as a key driver of recent rallies, though he warned of risks such as political instability, macroeconomic shocks, and fiscal pressures.

Meanwhile, flat steel stocks gained attention after Aisha Steel Mills projected a significant increase in sales for FY25, with a target of 210,000 tons, up from 167,000 tons in FY24.

Mohammed Sohail, CEO of Topline Securities, pointed to local mutual funds’ "non-stop buying" as a major contributor to early optimism. He also noted the role of TRG Pakistan Limited, whose announcement regarding a share repurchase agreement with IBEX Limited boosted investor sentiment.

Analysts remain optimistic about the market's medium-term trajectory, citing a possible decline in interest rates in December as a potential catalyst for further growth.