TRADE & ECONOMY

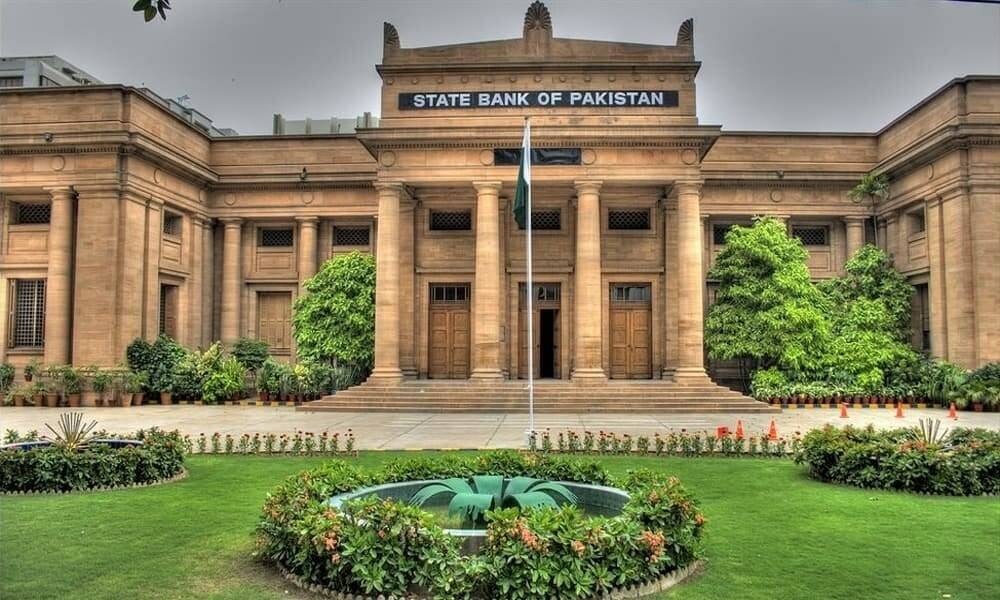

The State Bank of Pakistan (SBP) announced on Monday a 200-basis-point reduction in its key policy rate, bringing it down to 13% from the previous 15%. This move, effective from December 17, 2024, aims to address declining inflation and improve economic growth prospects.

According to a statement by the SBP’s Monetary Policy Committee (MPC), the decision was primarily driven by a continued decline in food inflation and the fading impact of November 2023’s gas tariff hikes. Despite this, the MPC noted that core inflation, currently at 9.7%, remains persistent, with inflation expectations among businesses and consumers still volatile.

“The MPC maintains its earlier assessment that inflation may remain volatile in the short term before stabilizing within the target range,” the statement said.

Positive Economic Indicators

The central bank highlighted key economic developments, including:

- A surplus in the current account for three consecutive months, bolstering SBP’s foreign exchange reserves to approximately $12 billion.

- Favorable global commodity prices benefiting domestic inflation and reducing the import bill.

- An increase in private sector credit, driven by eased financial conditions and banks meeting their advances-to-deposit ratio (ADR) thresholds.

The SBP also noted a recent uptick in high-frequency economic indicators, reflecting improved growth prospects.

Market and Government Response

Prime Minister Shehbaz Sharif welcomed the rate cut, praising the finance ministry and institutions for their efforts to revive the economy. “This reduction will enhance investor confidence and bring more investment into the country,” the premier stated.

The Pakistan Stock Exchange (PSX) responded positively, with the KSE-100 index climbing 1,867.61 points, a 1.63% gain, to close at 116,169.41 points.

Divergent Expectations

While financial analysts anticipated a conservative rate cut of 200 to 300 bps, businesses had pushed for a steeper reduction of 400 to 500 bps to spur economic growth. The current headline inflation rate, measured by the Consumer Price Index (CPI), fell to a 78-month low of 4.9% in November, leaving a highly positive real interest rate of 10%.

Despite the significant room for further reductions, experts warned against slashing rates to single digits, cautioning that it could destabilize the banking system and reignite inflation.

Economic Context and Outlook

The SBP has reduced the interest rate from a peak of 22% to 13% through four intervals since June. However, the steep drop in CPI suggests subdued economic activity, with the government and international agencies projecting GDP growth of 2.5% to 3% in FY25.

Analysts predict further inflationary easing, estimating December inflation to range between 3.5% and 3.9%, which could create room for additional rate cuts. Nevertheless, the finance minister recently hinted that the reduction would not exceed 300 bps in the near future.

As the central bank balances inflation control with economic growth, the latest rate cut marks a cautious yet hopeful step toward economic stabilization.